In February 2016, the Financial Accounting Standards Board (the “FASB”) issued a new lease accounting standard (Topic 842). The new lease accounting standard will impact financial reporting for entities that are required to report their financial results in accordance with U.S. generally accepted accounting principles. Topic 842 does not impact the tax treatment of leases. In addition, Topic 842 will not impact the many economic benefits realized by utilizing leasing as a source of financing. Leasing is still a great way to offer products to your customers and will continue to be an attractive financing option for your customers!

What are the effective dates for the FASB changes?

Topic 842 was effective for public companies for fiscal years beginning after December 15, 2018, and is effective for private companies for fiscal years beginning after December 15, 2021. Early adoption is permitted for all entities. Upon adoption, companies will be required to recognize and measure leases at the beginning of the earliest period presented in their financial statements or, alternatively, companies can recognize and measure leases at the adoption date along with a cumulative-effective adjustment to retained earnings. Although the new standard will be applied to all active leases at the time of transition, lessees may not be required to reassess lease classification upon transition.

NOTE: our experts have produced additional resources for you and your team, view them now.

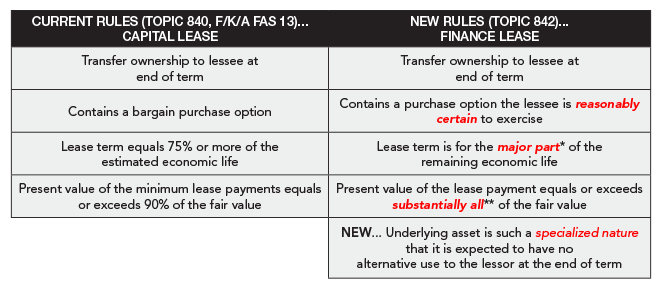

The FASB did retain a dual lease classification model. In other words, the new lease accounting standard maintains the concept of a finance lease (formerly a capital lease), and an operating lease. There were minor changes made to the lease classification criteria, primarily to remove the “bright lines” that exist in the current standard. A summary of the changes to the lease classification criteria are detailed on the

below table.

If a lease meets ANY of one or more of the following:

If a lease does NOT meet any of the above criteria, it is an operating lease.

*One reasonable approach would be to conclude that 75% or more is a major part of the remaining economic life.

**One reasonable approach would be to conclude that 90% or more is substantially all of the fair value.

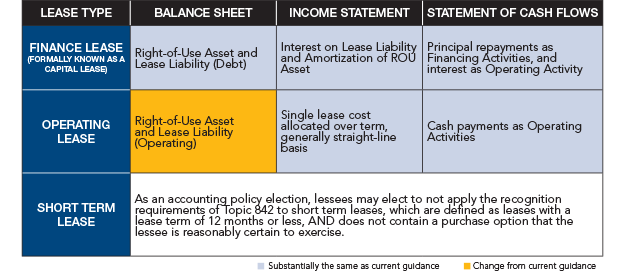

The main difference between the current standard and Topic 842 is the recognition of lease assets and lease liabilities by lessees for leases previously classified as operating leases. Although operating leases will be reported on-balance sheet, the lease liability is intended to be classified as an operating liability, rather than debt. Lessees should consult with their lenders to determine any potential impacts on their credit

lines and covenants.

Topic 842 applies to all leases, except short term leases (i.e., lease term is 12 months or less). Real estate leases will likely have a larger impact than equipment leases due to the size of the transactions. Entities should also consider adopting reasonable capitalization thresholds, below which, lease assets and lease liabilities are not recognized.

A summary of the financial reporting requirements under the new lease accounting standard can be found on the below table.

In bundled lease transactions that include both equipment and service/maintenance, only the equipment portion of the lease is required to be reported on-balance sheet. This is consistent with the current guidance for a capital lease. The lessee would make this determination based on the relative standalone price of the lease and non-lease components on the basis of their observable standalone prices. A price is observable

if it is the price that the supplier or a similar supplier would sell similar lease or non-lease components on a standalone basis. If observable standalone prices are not readily available, the lessee can estimate the standalone prices, maximizing the use of observable information.

Many entities have begun the process of evaluating the potential impacts of the new lease accounting standard. In addition to consulting with lenders, lessees should also consider consulting with their auditors regarding how the new standard will impact their financial statements, and their technology and software providers regarding changes to support the new standard.

Further resources:

Download a two-page flyer outlining the details about the FASB Topic 842 changes to share with your team.